Playbooks

Being the owner of your own business means you have to make a whole lot of decisions—big and small, in and out of your expertise, and in lightening speed. That’s why we created Playbooks, a shortcut to finding the information you need to get the job done.

A Playbook is a tactical walk-through to solve your most pressing business challenge. Whether you’re updating your marketing website or building up your referral growth loop, Playbooks give you a digestible ‘how-to’ think about your business challenge and action it.

A Playbook is a tactical walk-through to solve your most pressing business challenge. Whether you’re updating your marketing website or building up your referral growth loop, Playbooks give you a digestible ‘how-to’ think about your business challenge and action it.

Get step-by-step guidance to solve your most acute problems

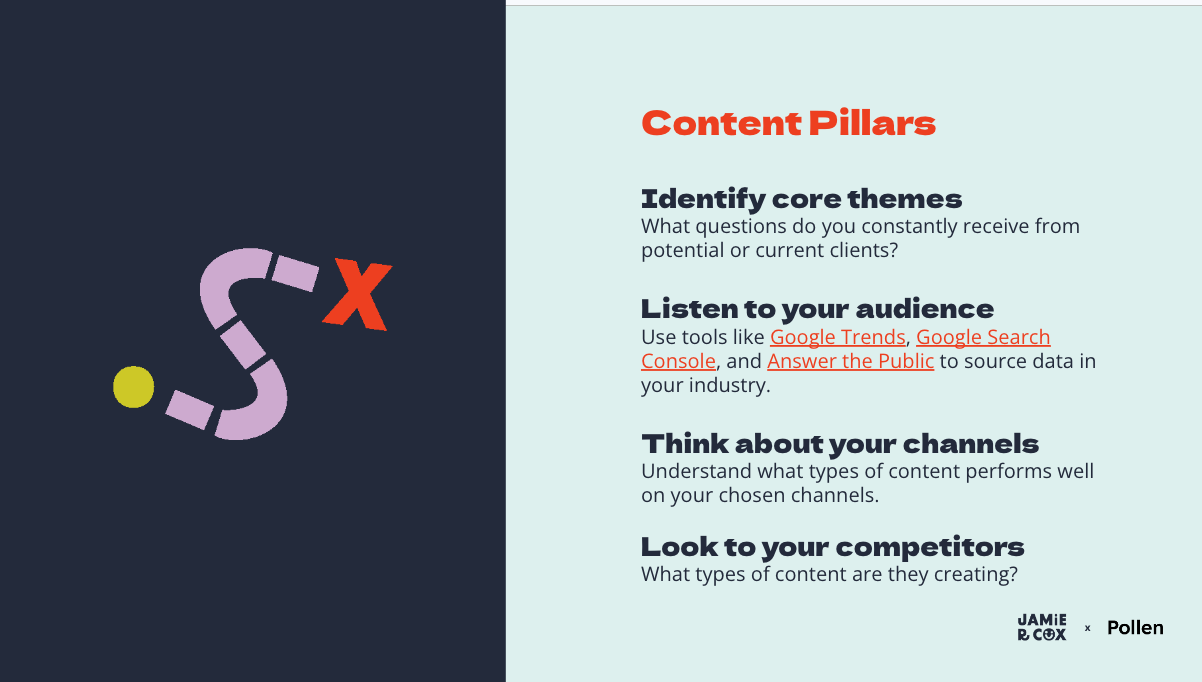

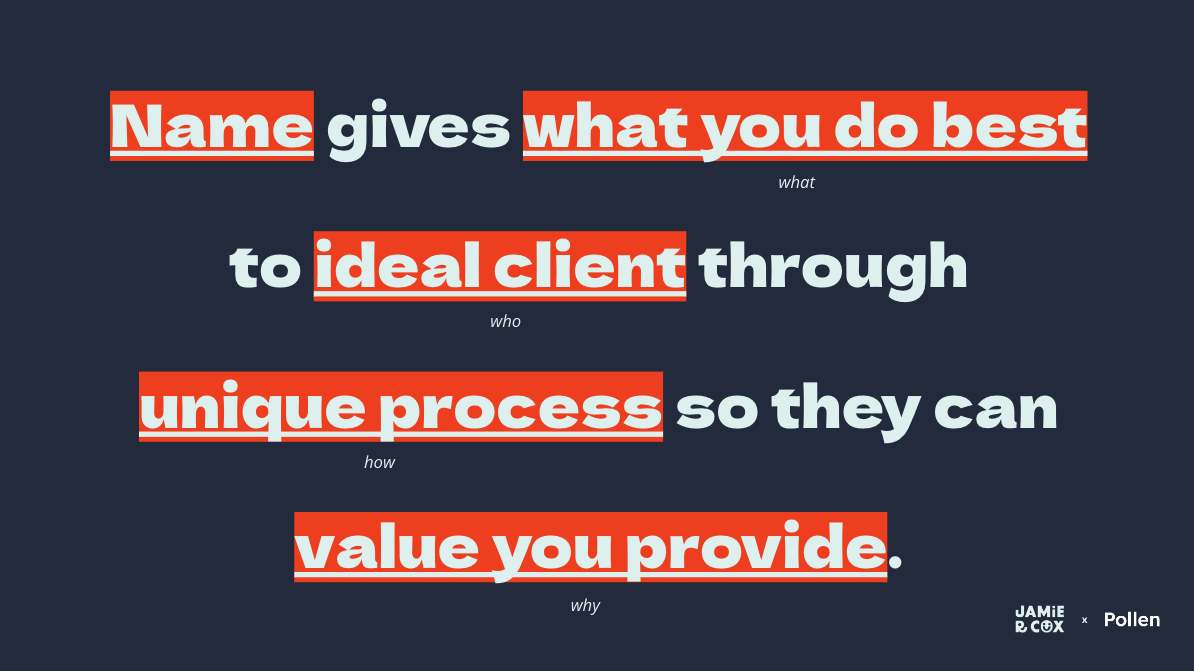

Learn actionable tactics and frameworks

Get the resource you need on your own time

Written by industry experts

Tactical walk-throughs to solve

your most pressing business challenge

your most pressing business challenge

.png)

Browse

Playbooks

Playbooks

Get step-by-step instructions to navigate your challenge, so you can easily move into action — and gain the confidence of knowing you’re learning from those who have done it before.

EXPLORE ALL FEATURES

Weekly events

Prioritize real progress with multi-week sprints, single-session workshops, and connect with fellow members.

Vetted Community

.png)

This is what they mean when they say “find your people.” Pollen’s community of experts who know what it takes to go solo—all the triumphs and self-belief it requires—and they’re in it with you.

Pollen membership pricing

Unlock the full power of a Pollen membership to take your

independent consulting business to the next level.

independent consulting business to the next level.

Your Pollen membership includes unlimited access to

Sprints, events, and live workshops

Vetted community of peers and experts

Premium resources and tools

Have questions?

Book a call with a member of our team

.png)

.png)

.svg)